Some markets are blessed with wealthy consumers and sizeable populations; others aren’t as fortunate. Entrepreneurs in the former have the latitude to focus on growth in their home countries; however, in the latter, entrepreneurs seeking scale have to look outwards relatively early in their journeys.

African markets, generally speaking, belong in the second bucket. As such, startups targeting African markets would do well to adopt a multi-country mindset early on.

On the one hand, most African markets are relatively small, and on the other, many African markets are highly uncertain. Given these characteristics, entrepreneurs seeking rapid growth and venture scale in African markets should begin thinking about geographic diversification and market expansion at the onset.

Scale: meaningful scale comes via market expansion

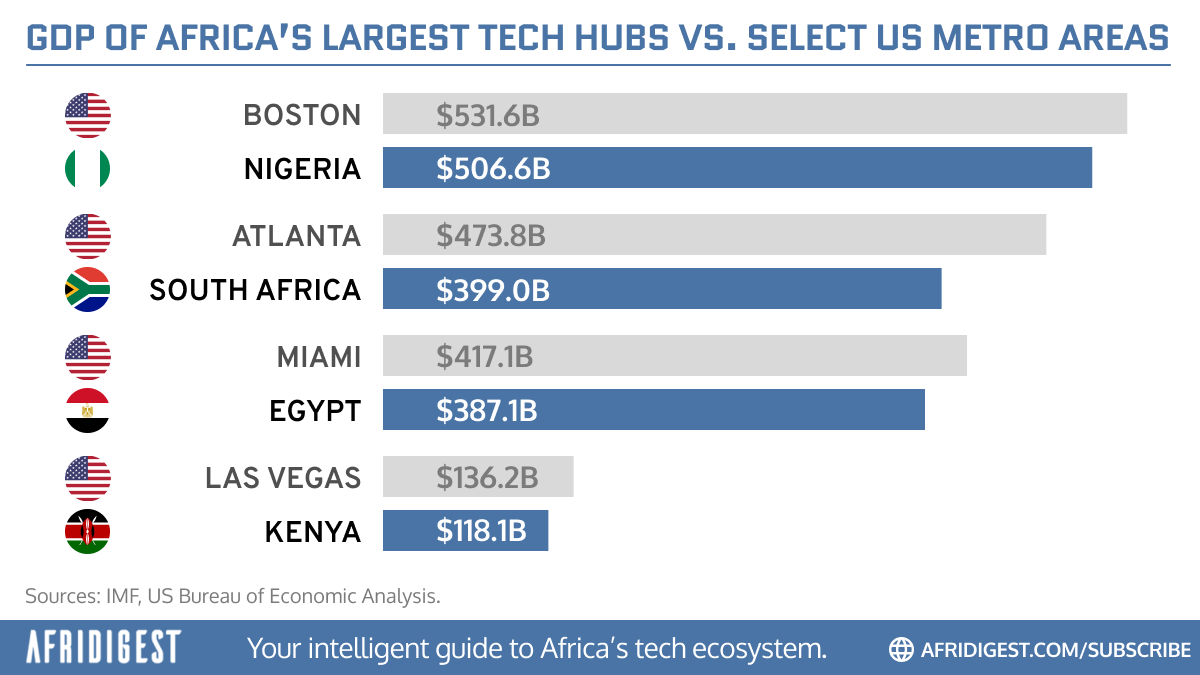

While the African continent currently has a population of ~1.5 billion people, GDP per capita in sub-Saharan Africa was only ~$1,600 in 2021, compared to ~$68,000 for North America and ~$38,000 for the European Union, according to the World Bank. This points to much smaller total addressable market sizes across Africa for most non-staple products & services. Compounding this issue is the fact that today’s African markets are marked by fragmentation — thus, market sizes in any given country tend to be further limited. (See for example, ‘A potent way to compete in Africa’s fragmented markets is by deploying platforms.’)

Nigeria, the so-called ‘giant of Africa’ with its purported population of ~200 million is an instructive example. While many have been and continue to be seduced by the market’s ‘latent potential,’ experienced industry analysts including Dr. Ola Brown and Professor Ndubuisi Ekekwe have sounded alarms for those who would hear. They argue that the true consumption opportunity in the country (for non-essential goods & services) is much smaller — closer to 30-60 million people.

Given these on-ground realities, it makes sense that entrepreneurs in Africa seeking venture scale should prepare for early expansion to other markets. This is also bolstered by various entrepreneurs with long-standing experience across African markets. For example, Dare Okoudjou who founded pan-African fintech firm MFS Africa in 2009 shares this advice:

Stability: geographic expansion mitigates against uncertainty

The search for scale is not the only reason to look beyond a home country’s borders however. Another reason to venture outwards on the continent is the high levels of uncertainty present in many African markets: of regulations, of exchange rates, of political stability, and more. Examples abound.

One way startups can reduce this ‘uncertainty risk’ in a given market is by pursuing geographic diversification early on. Nigerian serial entrepreneur Sim Shagaya shared his thoughts on the role diversification plays in mitigating against shocks in any given market and making startups more stable:

Considerations

For companies that decide early on to pursue international expansion in African markets, one key challenge is where to go.

Here, there seem to generally be two schools of thought: pursue adjacent opportunities within regional clusters or target the highest potential markets across the continent with no regards to proximity (e.g., going from Nigeria to Kenya to South Africa).

While success can arguably be found with either strategy, it beehoves entrepreneurs to take a sober view of what it takes for aggressive, long-distance expansion and perhaps eye more proximate opportunities. Investment banker Victor Basta offers this input:

Among the companies that have recently reconsidered their expansion plans are SweepSouth, which recently exited Nigeria and Kenya to focus on South Africa; Safeboda, which recently exited Nigeria to concentrate on its ‘profitable’ Ugandan operations; and mobile money unicorn Wave, which recently pulled back from its newer markets Uganda, Mali, and Burkina Faso to focus on its core markets: Senegal and Ivory Coast. While these decisions appear to be driven by the current market downturn, they’re nonetheless a testament to the complexities involved in cross-continental expansion.

Aside from where to expand internationally, another consideration for startups that pursue international expansion is how to make such expansion additive. In theory at least, the company should have proved or disproved certain hypotheses in its home market, and developed insights, playbooks, and processes that allow it to operate more efficiently in a new market. Successfully doing so can make a startup quite attractive to investors as financial advisor Victor Basta explains:

The last word

Given the stage of development of African markets and their current structure, entrepreneurs on the continent face challenges that are quite dissimilar to those faced by their counterparts in the West. (See, for example, ‘African Innovators Should Look East, Not West, For Business Model Inspiration.’)

Entrepreneurs that target African markets and seek venture scale should seriously reflect on international expansion sooner than later to maximize the chances of success. For those in smaller markets, this early multi-country mindset comes natural; however those in larger markets (e.g., Nigeria) should guard against the seductive siren song of single-market focus.

Interested in expert advisory for successful expansion across Africa? Africreate offers strategic intelligence as a service to leading startups, corporates, and investors across African markets. Say hello: hello@africreate.com

Share: